The Reserve Bank of New Zealand (RBNZ) has just cut the Official Cash Rate (OCR) by 50 basis points to 2.5%, marking the largest drop since 2020. This bold move aims to reignite growth in a sluggish economy and it’s set to have major flow-on effects for New Zealand’s housing market and mortgage rates.

Cheaper borrowing: Lower OCR means banks can borrow more cheaply, so mortgage rates fall. Buyers suddenly have more spending power, which typically lifts demand.

Buyer confidence returns: After months of uncertainty, first-home buyers and investors are expected to re-enter the market.

Price momentum: Analysts forecast 2-3% house-price growth through 2025, especially in Auckland’s mid-priced suburbs where supply remains tight.

Investors re-engage: The combination of cheaper credit and soft prices could pull investors back, particularly in high-yield suburbs.

Moderate rebound: Growth will likely be steady rather than explosive with tighter Debt-to-Income (DTI) rules and cautious lending tempering the pace.

In short: expect renewed activity through summer, stabilising prices by early 2026 if migration and employment remain strong.

Buyers: Affordability just improved—lower repayments may boost your borrowing capacity.

Sellers: Expect more enquiries as confidence builds, especially in entry-level and family segments.

Investors: Cheaper credit plus steady rents mean stronger yields; timing your purchase before prices lift could pay off.

Homeowners: Refinancing could save thousands annually; talk to your bank or broker about rate options.

OCR slashed to 2.5%—biggest cut in years.

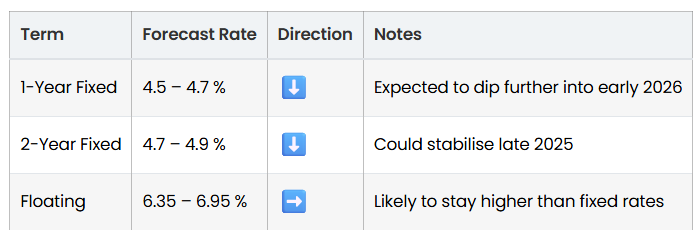

Mortgage rates dropping towards mid-4% range.

Housing demand rising as affordability improves.

Price growth forecast: 2-3% over 2025.

Best window to refinance or buy before rates stabilise again.

Economist Tony Alexander says the jumbo OCR cut is “a clear signal the Reserve Bank wants households to spend and businesses to invest again.” Kiwibank economists add that “lower rates will revive housing turnover through 2025, though the rebound will be gradual.”

The RBNZ’s rate cut is likely to mark the turning point in New Zealand’s property cycle. While the economy remains soft, cheaper finance, limited housing supply, and returning buyers set the stage for a moderate recovery through 2025-2026.